Everything About Routing Number

Feb 06, 2024 By Triston Martin

The American Bankers Association (ABA) uses ABA transit numbers, also known as ABA routing or routing transfer numbers, to identify particular financial institutions in the United States. These numbers are printed on standard checks. What is the routing number on a check? Its simplest form is a numeric address consisting of nine digits assigned to each bank. The distribution of routing transit numbers is restricted to federally chartered and state-chartered financial institutions that meet the requirements to maintain an account with a Federal Reserve Bank. The number is used to conduct various financial operations, including direct deposits and wire transfers.

Understanding ABA Transit Numbers

When the Federal Reserve Routing System was initially established, the first four digits of a bank's routing number indicated the actual location of the bank.

How Transit Numbers Work

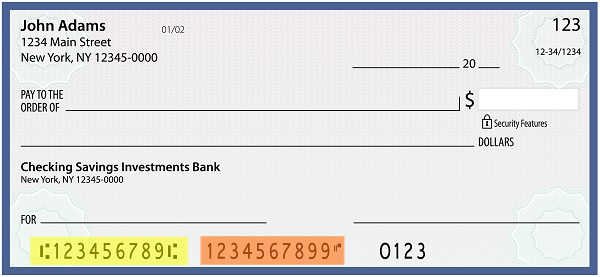

The routing transit number of a bank is the first nine digits on the far left of the bottom of a check. This number may be found at the bottom of a check. The first four numbers identify the Federal Reserve Bank branch responsible for the district in which the institution may be found. The following four digits identify the bank itself, while the final digit serves as a classification indicator for the check or other negotiable instrument.

What Is A Bank Routing Number?

These statistics do not reflect a physical location in the year 2019 due to the high number of bank mergers and acquisitions. The following two numbers indicate the Federal Reserve bank is utilised to route the electronic transaction. This bank's routing number begins with a 9. The seventh digit determines which check processing centre is allocated to the bank by the Federal Reserve. The eighth digit determines which Federal Reserve district the bank is located in.

The first eight digits of the number are used in a complicated mathematical equation represented by the last digit. The checksum functions as a preventative measure. If the last number and the first eight digits of the transfer do not add up to the same total, the transfer is flagged as suspicious and sent back to be manually processed, which is a much slower procedure.

The routing number used by the ABA

On the majority of checks, the ABA routing number is printed in two different formats: first, as a nine-digit number that can be read by a machine in the bottom left corner (followed by the checking account number), and second, as a fraction in the top right corner. The first version, which is the one used for processing checks, is referred to as the magnetic ink character recognition (MICR) form.

The second is a relic from the days when checks were processed by hand and included most of the same information in a format unique to that period. The second form is nevertheless used as a fallback if the format that is readable by machines cannot be read. The numbers in MICR form enable computers to "read" or identify the numbers, regardless of whether or not the magnetic strips are present. A financial institution must demonstrate that it is qualified to maintain an account with a Federal Reserve bank before it can be granted an ABA transit number.

Example of How to Make Use of an ABA Transit Number

In such a situation, you will need to provide your employer with both the number of your checking account and your ABA transit number. The banks will see to it that everything else is taken care of. In the past, paper checks were shipped to the receiver or the bank of the recipient. This process required much more time than electronically delivering a check to the recipient. Instead of waiting for a check to arrive and subsequently clear in an account, it is now possible for checks to be cleared electronically and practically immediately, thanks to the Check 21 Act, passed in 2004. The speed with which checks are processed is directly correlated to the use of the ABA transit number.

What Is A Bank Routing Number?

In most cases, you may find them in the bottom left-hand corner of a check or an online account's information portal. The following two numbers indicate the Federal Reserve bank is utilised to route the electronic transaction. The number is used to conduct various financial operations, including direct deposits and wire transfers.

Know-how

Apex Trader Funding: A Deep Dive into Its Key Benefits and Features

Explore Apex Trader Funding's supportive environment, flexible evaluations, and transparent profit-sharing models that empower traders at all experience levels.

Learn More

Taxes

4 Ways the IRS Can Seize Your Tax Refund

Your refund could be seized by the IRS if you owe unpaid taxes to the federal and state governments. If you owe back child support or student loan debt, the IRS has the right to seize your refund. Contact the IRS if you believe there has been an error.

Learn More

Know-how

Decoding Commodity Pairs and their Implications on Currency Correlations.

Learn about commodity pair impact on global trade and economics by understanding the intricacies of currency correlation in the foreign exchange market.

Learn More

Know-how

Money Metals Exchange: A Comprehensive Review of Its Reputation

Discover how Money Metals Exchange stands out with transparent pricing, exceptional customer service, and educational resources for precious metals investors.

Learn More

Banking

Discuss in Detail: The Best 5-Year CD Rates

Long-term deposit certificates are available with maturities of 10 years or more; however, the most typical longer-term CD is for five years. If you choose to invest in a CD with a term of five years, you are committing to keeping your money in the account for that time. There has always been a trade-off between the length of a certificate's term and the rate of interest or dividends it offers.

Learn More

Banking

Locate Your Lost 401k Accounts Effortlessly with Beagle 401k Finder

Discover how the Beagle 401k Finder can help you locate lost 401k accounts with ease. Ensure your retirement savings are secure and accessible

Learn More