Discuss in Detail: The Best 5-Year CD Rates

Dec 12, 2023 By Triston Martin

Introduction

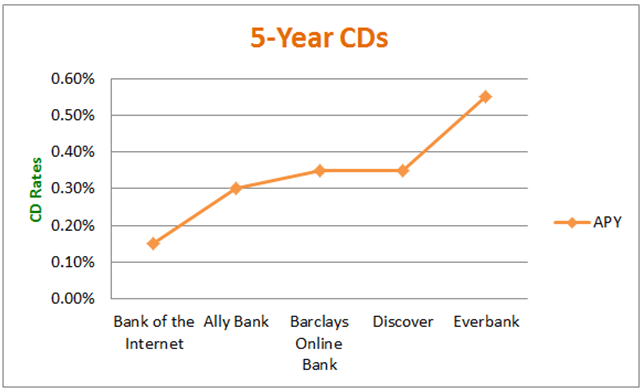

Five-year CDs are widely available at financial institutions around the country. However, the interest rates that financial institutions provide on these CDs might vary widely. The nation's finest certificates of deposit (CDs) currently pay over 1.25 percent interest. We regularly analyse and assess the CD rates offered by over 200 banks and credit unions around the US to assist you in locating the best 5-year CD rates and optimising your earnings. To be included in our top 10 lists, a financial institution must be federally insured (by the FDIC in the case of banks or the NCUA in the case of credit unions). It must provide certificates of deposit with a minimum opening deposit of $25,000.

First Internet Bank Of Indiana Certificate Of Deposit

You won't make as much money because the interest is compounded just once a month instead of every day by First Internet Bank of Indiana. To what extent this matter depends on the total amount of your CD.

Popular Direct

Direct banking is what Popular Direct is all about, and Popular Bank has been providing it for 128 years in Puerto Rico and 55 years on the American mainland through its subsidiary, Popular Bank. Only savings and certificate of deposit accounts are available through Popular Direct.

Popular Direct offers CDs with durations ranging from three months to five years at competitive rates throughout the board, but the minimum deposit is a hefty $10,000. Popular Direct has more outstanding early withdrawal fees than its rivals. If you withdraw money from a five-year CD before it matures, you will be penalised 730 days' worth of interest. The pricing, though, is competitive with the best we've seen thus far. In exchange for a $10,000 minimum investment over five years, you would receive $11,820.

Capital One 360 Certificate Of Deposit®

Where you live can affect how you interact with banks. You can open a certificate of deposit at any bank's locations in Connecticut, Delaware, Louisiana, Maryland, New Jersey, New York, Texas, Virginia, or the District of Columbia.

First Internet Bank Of Indiana

According to its website, the Only Internet Bank of Indiana is the first state-chartered, FDIC-insured bank that offers its full service to consumers via the internet. It provides various banking services, such as checking, savings, money market, individual retirement accounts, credit cards, loans, and certificates of deposit. The longer-term CD rates of First Internet Bank are among the finest in the industry. The bank offers CDs with terms ranging from three months to five years. CDs from First IB are low-risk and low-cost because a minimum deposit of only $1,000 is required.

Marcus By Goldman Sachs High-Yield Cd

Marcus has several Certificate of Deposit options, and their 5-year CD rate is among the best. The $500 CD initial deposit requirement is lower than the market average.

CFG Bank

In its own words, CFG Bank takes an "entrepreneurial approach" to banking. The primary products of CFG Bank, which has been around since 2009, are checking, savings, money market, and certificate of deposit accounts. It operates several traditional bank locations in New England and the Middle Atlantic. Certificates of Deposit are available from one to five years at CFG Bank. With only a $500 initial investment, there is little standing in the way of new players. CFG Bank's five-year CD APY is the highest we could locate, but it only allows a single deposit and does not allow further warranties. Investing $500 for five years in a Certificate of Deposit would return $590.

Pros And Cons Of 5-Year Cds

A CD that lasts five years is a serious financial commitment. It would help if you weighed the benefits and drawbacks of tying up your money for such a long time in a CD before making such a significant commitment.

Pros

- Earnings yields that are higher. Five-year CDs often have higher interest rates than other CD terms.

- You have been locked out of your own money. A certificate of deposit with a duration of five years can be helpful if you wish to avoid the temptation to withdraw your funds for a long time. There is usually a substantial penalty for cashing out your retirement savings early.

Cons

- There is no way to get better annual percentage yields. Your ability to earn a greater interest rate on your cash from a certificate of deposit could decrease if interest rates rise throughout the five years of your CD.

- Costs for making an early withdrawal. There may be hefty fees for making an early withdrawal. In the event of an unexpected expense, you may need to withdraw funds from your five-year CD.

Conclusion

Given the significant time commitment in purchasing a 5-year CD, it often offers the highest CD rates. If you shop around, you may make three-to-five times as much as the national average rate on 5-year CDs. It is possible to earn 5-year rates on all of your CD investments by using a CD ladder, which consists mainly of 5-year certificates, while still having access to one-fifth of your assets once a year. If your financial situation changes and you need to withdraw funds before the 5-year CD's maturity date, you should consider the early withdrawal penalty policies.

Banking

Denied Because of Insufficient Credit References

Some lenders will refuse loans or credit cards if applicants do not have sufficient credit ratings. This is simply because there's not enough information in your credit report to allow your lender to make an educated choice regarding your creditworthiness.

Learn More

Know-how

4 Global Economic Issues Of An Aging Population In 2022

The social and economic repercussions of an ageing population are starting to become more obvious in many industrialised countries all over the world. The population is ageing faster than at any other time in history, which presents policymakers with several interconnected challenges, including rising costs of health care, unsustainable pension promises, and shifting demand drivers within the economy.

Learn More

Taxes

Simplifying Form 3800: Leveraging General Business Credits for Growth

Dive into our comprehensive guide on Form 3800: General Business Credit. Learn how this essential business tax form can benefit your company and simplify your tax filings

Learn More

Know-how

How to Buy a House Out of State?

A massive choice is purchasing a home. It's also an exciting one, but it isn't easy. If you've decided that you want to buy a house but aren't sure where or how, this guide will help!

Learn More

Mortgages

What Is the Meaning of a Balance Transfer?

The amount of money owed on credit cards can quickly accumulate, especially in the weeks after the winter holidays. But there are a few credit cards that can help you wipe out a large balance without being hit with excessive interest charges, and anyone wanting to get a handle on their debt should know that these cards are available.

Learn More

Banking

What Credit Score Do Car Dealerships Check?

The credit score car dealers really use is your FICO auto score of 8. This number is based on various factors, such as your payment history, length of credit history, new credit inquiries, and debt utilization.

Learn More